are union dues tax deductible in nj

California along with other states including Pennsylvania and New York. Employers disclose Union Dues paid by employees in Box 14 on Form W-2.

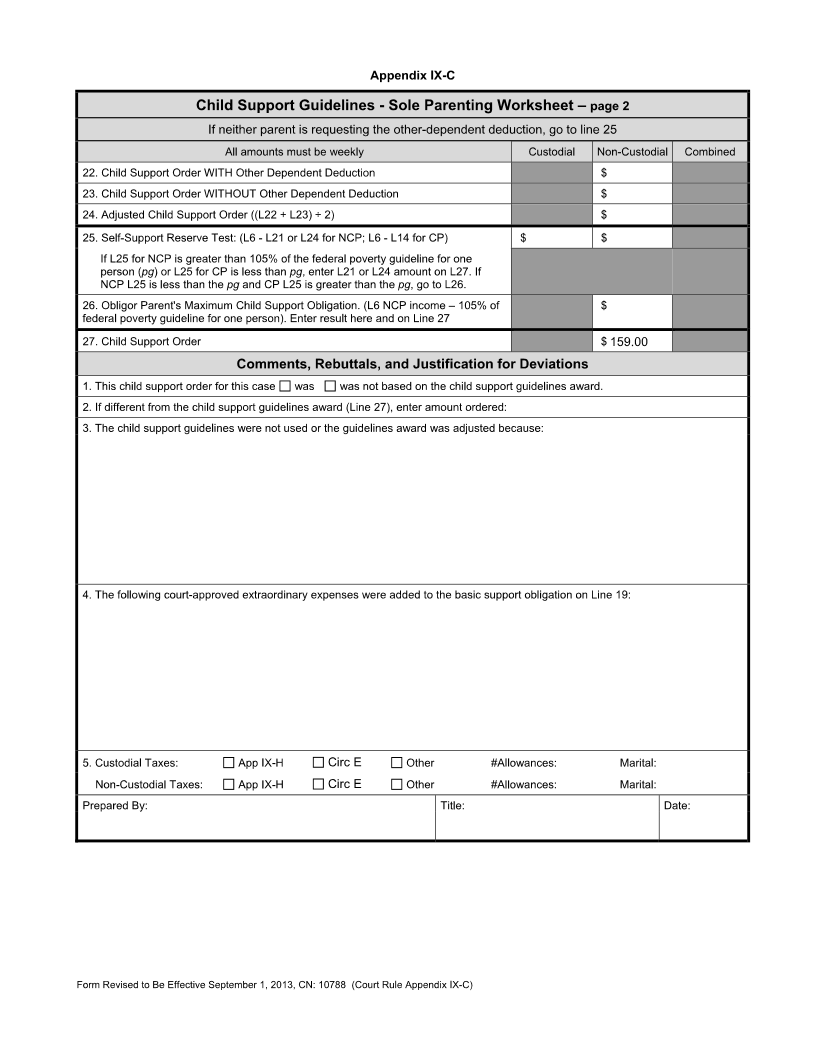

How Much Child Support Will I Pay In New Jersey

Blog Union Dues Are Now Tax Deductible.

. Californias proposed Workers Tax Fairness Credit would be the countrys first tax credit for union dues. You can deduct dues and initiation fees you pay for union membership as unreimbursed employee. The Union will supply an appropriate form to the Employer so those new.

Section 138514 gives union members an above-the-line deduction for up to 250 for their membership dues. Posted on January 31 2019 January 31 2019 by Catherine Kraus. The bill the House passed would allow union.

The answer to your question is that the deduction for union dues and all employee expenses has been eliminated for tax years 2018 through 2025 regardless of whether an. The dues for persons eligible for active professional or active supportive membership who are on an approved unpaid leave of absence shall be one-half of the full dues. Number 11 Pages 1295 1406 Law Library The New Jersey State New Jersey Unemployment Tips Hotel.

This provision rewards labor union bosses with taxpayer subsidies. The Supreme Courts ruling made clear that a government employer cannot deduct union dues or fees from employees paychecks unless the employee has clearly and affirmatively consented. More information is available on the.

The Employer further agrees to automatically deduct Union dues from the wages of all new employees. Are union dues tax deductible in nj Monday February 21 2022 Edit. On June 27 2018 the United States Supreme Court issued an important employment law decision in the case of Janus v.

Local 196 dropped any claim for union dues fees or other monetary compensation from the plaintiffs from January 1 2022 on. The bus drivers also are due a refund for union. If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit.

Effective in 2019 union. NJ requires you to take standard deduction if you did so federally. But if you took the itemized deduction NJ taxes health insurance premiums so they can be itemized in your NJ return as.

Union Members May Opt-Out of Paying Dues. The employees net pay is then reduced by any post-tax deductions including union dues donations to charity wage garnishments etc.

Itemized Deductions Pub 4012 Tab F Pub 4491 Lessons 20 Ppt Download

Notes Handouts Pub 17 Chapter 21 Through 29 Pub 4012 Tab 4 Ppt Download

Stateaidguy Sure Njea S Powerful But Nj Teachers Don T See Much Benefit In Their Paychecks Nj Education Report

Union Dues To Be Deductible From New York State Taxes Spivak Lipton Llp

Itemized Deductions Pub 4012 Tab F Pub 4491 Lessons 20 Ppt Download

Irs Criminal Investigations In New Jersey

Nj Division Of Taxation Sales And Use Tax

New Bill Would Restore Tax Deduction For Union Dues Other Worker Expenses

Deducting Union Dues Drake17 And Prior

Filing New Jersey State Tax Things To Know Credit Karma

New Jersey Deductions For Higher Education Expenses And Savings Kulzer Dipadova P A

April 15 Won T Be Tax Day This Year Here S How Much More Time You Ll Get Nj Com

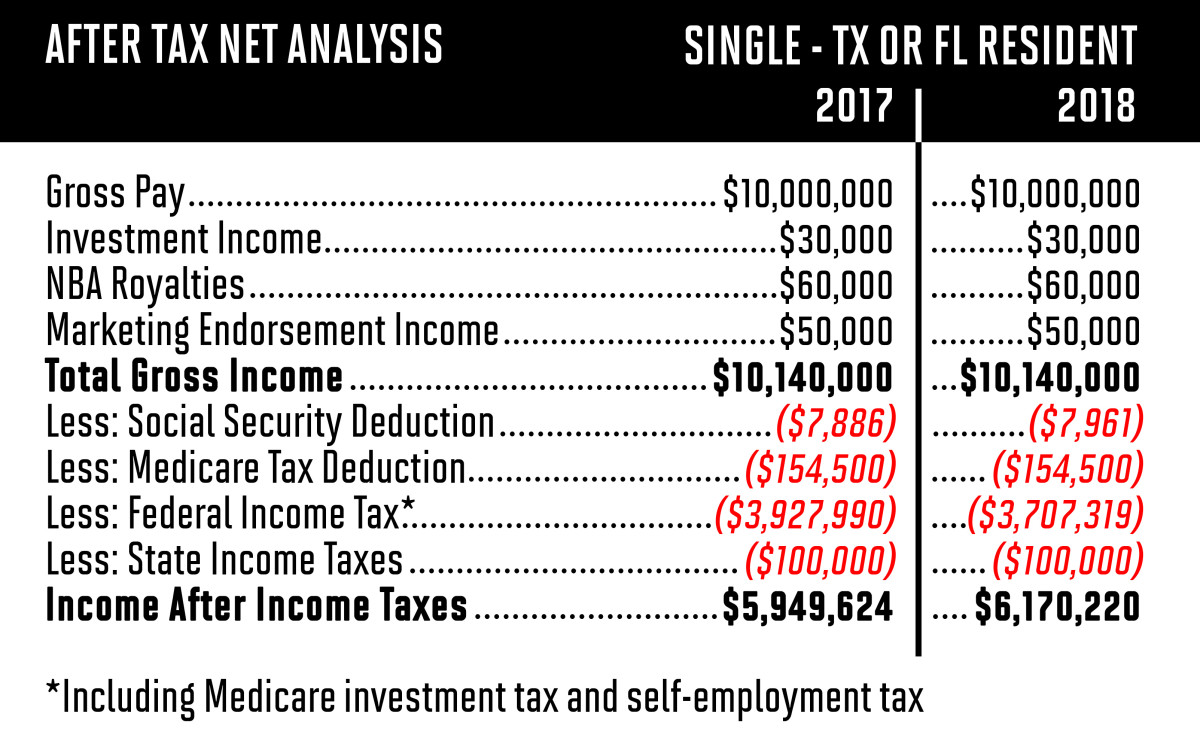

Trump S New Tax Bill The Impact On Star Athletes Sports Illustrated

Lambertville Halloween Film Festival Arts Cultural Council Of Bucks County

Stateaidguy Sure Njea S Powerful But Nj Teachers Don T See Much Benefit In Their Paychecks Nj Education Report

Deduct Your Union Dues From Your New York State Income Taxes Hotel Trades Council En

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News